Ah, bubbles. No, not the kind you blow with soap and a wand (though those are fun too). We’re talking about the kind that make people throw money at things like tulip bulbs, pixelated apes, or AI chatbots that occasionally hallucinate about being Shakespeare. A bubble is what happens when hype, hope, and a dash of delusion collide, creating a frenzy where everyone thinks they’re about to get rich—until, of course, they’re not.

Hype, on the other hand, is like that friend who convinces you to buy a pet rock because it’s “the next big thing.” It’s the glittery, over-the-top excitement that makes us believe fully autonomous humanoid bots are just around the corner. And tech? Oh, tech loves hype. It thrives on it. From the dot-com boom to crypto mania to the current AI obsession, tech has been fickle minded.

So, what’s next? After AI has had its moment in the sun (and possibly its moment of crashing back to Earth), what will be the next shiny object to capture our collective imagination—and wallets? In this speculative research piece, I am hoping to explore some technologies which have the potential to be the next big thing in the ever changing word of technologies.

First let us try to understand what a “Bubble” actually means in a technical point of view.

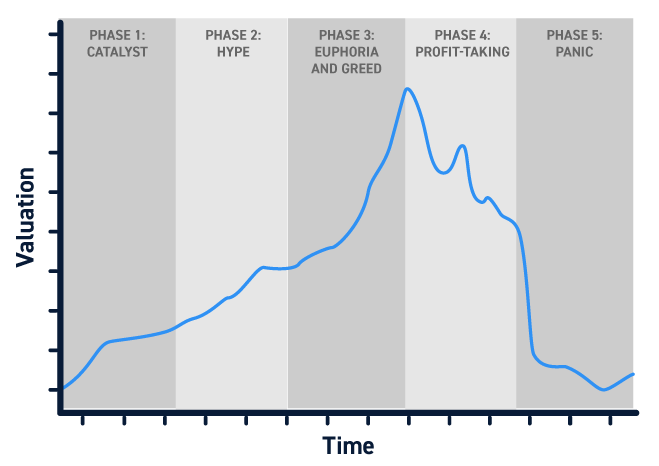

Market bubbles are a well-documented phenomenon, where the price of an asset

or sector becomes grossly inflated, detached from its underlying intrinsic value. These bubbles are often fuelled by speculative frenzy, hype, and the fear of missing out, rather than sober assessments of fundamentals. A market bubble has some defining characteristics:-

- Rapid and sustained price appreciation: Bubble assets typically experience exponential price growth over a relatively short period, far outpacing any reasonable assessment of their actual worth.

- Widespread investor enthusiasm and FOMO: As prices climb, a sense of excitement and the fear of missing out (FOMO) grips the market, leading to a self-reinforcing cycle of increased investment and further price appreciation.

- Lack of underlying fundamentals: The skyrocketing prices are not supported by the asset’s intrinsic value, earnings, or other objective measures, but rather by the belief that prices will continue to rise indefinitely.

- Unsustainable valuation metrics: Bubble assets often exhibit extremely high price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, or other valuation multiples that are completely detached from historical norms.

From a technical perspective, market bubbles are defined by key dynamics: positive feedback loops, where rising prices fuel more investment, driving prices even higher; exponential price growth, often resembling a hockey-stick curve with a sudden vertical surge; increased volatility, marked by erratic price swings as the bubble peaks; and widening bid-ask spreads, signaling dwindling liquidity and uncertainty about the asset’s true value. These features collectively create a fragile, speculative environment ripe for a crash.While bubbles can create the appearance of rapid wealth generation, their bursting inevitably leads to painful corrections that reverberate through the broader economy. The fallout from these bubbles can be severe, resulting in job losses, business failures, and significant erosion of household wealth. However, it’s not all doom and gloom – bubbles can also provide opportunities for savvy investors who time the market correctly.

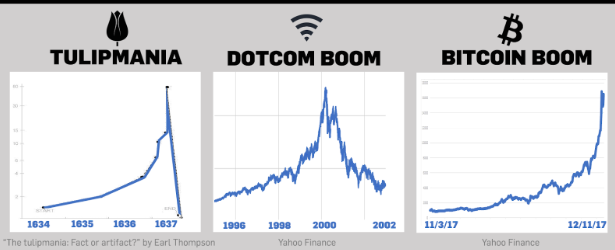

Throughout history, we’ve witnessed several prominent examples of market bubbles, each with its own unique characteristics and impacts. Let’s take a closer look at a few of the most infamous cases:

The Dutch Tulip Mania (1630s):

During this period, rare tulip bulbs became the object of intense speculation, with prices skyrocketing to astronomical levels. At the height of the mania, a single tulip bulb could fetch the equivalent of 10 times the annual income of a skilled craftsman. The bubble’s collapse led to widespread financial ruin and a prolonged economic downturn in the Netherlands. This early example of herd mentality and irrational exuberance serves as a cautionary tale about the dangers of unbridled speculation.

The California Gold Rush (1848-1855):

The discovery of gold in California sparked a frenzy of prospecting and investment, driving up the prices of land, goods, and services to unsustainable levels. Opportunistic entrepreneurs and speculators flooded the region, fueling a bubble that eventually burst. The eventual bust resulted in economic hardship and social upheaval, as the rush of wealth creation gave way to a period of job losses, business failures, and widespread financial distress.

The Dot-Com Boom (1995-2000):

The rapid growth of the internet and the emergence of tech startups fueled a speculative bubble in the 1990s, where investors poured money into unproven, loss-making companies. Fueled by the promise of the “new economy,” the Nasdaq Composite Index skyrocketed, with many tech stocks trading at astronomically high price-to-earnings ratios. The bubble’s bursting in 2000 devastated the tech sector and led to a prolonged economic downturn, with the Nasdaq losing over 75% of its value from its peak.

Cryptocurrency and NFTs (2017-2022):

The rise of Bitcoin, Ethereum, and the broader cryptocurrency market, as well as the hype around non-fungible tokens (NFTs), have been characterized by periods of intense speculation and volatility. Concerns about the sustainability of these assets and their potential impact on the financial system have led to ongoing debates and regulatory scrutiny. The cryptocurrency market experienced a major correction in 2022, with Bitcoin and other digital assets losing a significant portion of their value, underscoring the fragility of these speculative bubbles.

AI Hype (2020-present):

The recent advancements in artificial intelligence, particularly the rapid development of large language models and generative AI, have captured the public’s imagination and sparked a new wave of investment and excitement. However, there are concerns that the current AI hype may be creating the conditions for a potential bubble, as investors and companies rush to capitalize on the perceived potential of these technologies, often without a clear understanding of their limitations and long-term viability.

The current AI hype cycle shows no immediate signs of slowing down. Every week brings new breakthroughs, bigger models, and ever-more ambitious valuations. Companies are racing to add “AI” to their names and pitch decks, reminiscent of how firms added “.com” during the 1990s internet bubble or “blockchain” during the crypto boom. But like all technological waves, AI’s monopoly on investor attention and public imagination will eventually give way to the next big thing.

These historical examples serve as a sobering reminder that the allure of easy money and the power of FOMO can lead to the formation of market bubbles, which inevitably burst, leaving a trail of economic and social devastation in their wake.

History teaches us that technology bubbles don’t just vanish – they tend to shift, morphing into new forms as investor enthusiasm finds fresh targets. Just as the ashes of the dot-com crash ultimately gave rise to today’s tech giants, and crypto’s decline coincided with AI’s ascendance, the next major bubble is likely already taking shape on the horizon. While predicting exactly when the AI bubble might deflate is a fool’s errand, identifying where the next surge of irrational exuberance might flow is both possible and prudent.

In this series, I’m peering into the tech crystal ball to figure out what’s next on the hype train. Will it be rockets aiming for Mars (or just fancy fireworks)? Maybe we’ll rewrite the code of life with genetic engineering, or finally find an energy source that doesn’t doom us all. And let’s not forget the quest to build a rig that can run GTA 6 at 60 FPS. We’ll explore Space Exploration, Genetic Engineering, Energy Innovations, and the ever-shrinking world of Semiconductors.

Further Reading

- https://hexn.io/blog/tech-bubbles-explained-978

- https://academy.wirexapp.com/post/tulip-mania-explained

- https://ca.investing.com/news/cryptocurrency-news/tulips-dotcom-and-crypto-dissecting-market-bubbles-through-historys-lens-2992381

- The AI Boom and the Dot-Com Bubble: History Rhyming? | by Curiouser.AI | Medium

- Understanding the Impact and Risks of the Tech Bubble | by Sara Irshad | City Pulse | Medium

Leave a comment